China's PV market as a whole after the 531 New Deal

the Internet

2019-04-20 10:39:45

After the rigorous "531 New Deal" and the subsidy policy continues to be shortened, China's PV shopping malls will gradually develop from incremental shopping malls to buying and selling malls, and occupational concentration will be improved after integration. The above speculation was made by PricewaterhouseCoopers China and TÜV Rheinland Group (hereinafter referred to as TV Rheinland) recently released the "2019 White Paper on the Sale and Purchase of Photovoltaic Power Plants in China" (hereinafter referred to as "White Paper"). The "White Paper" believes that in the future, China's new distributed photovoltaics will become the main force beyond centralized photovoltaic installation. It is estimated that by 2020, the proportion of distributed PV in China's cumulative PV installation will increase from 29% at that time to over 40%.

The "White Paper" speculates that in the short-term, under the big picture of the tightening of the photovoltaic policy and the slowdown of macroeconomic growth, ChinaPhotovoltaic mallThree major trends will be presented: the new installed capacity will be reduced; the new installed capacity of distributed PV will exceed the centralized installed capacity and become the main force of new dedication; the PV subsidy will gradually withdraw from the shopping mall, and the parity online will be available.

In the past, the situation in which the occupational trading of photovoltaic power plants in China was relatively faint will also change. According to the White Paper, with reference to the Japanese experience, when the PV subsidy price dropped to about 40% of the peak, the mall changed from incremental to trading, and after the 531 New Deal, China's PV benchmark price was lowered by 30% from the highest peak. 40% is now near the critical value.

According to the statistics of the "White Paper", the domestic PV power plant property shopping malls showed explosive growth after the 531 New Deal: before the New Deal, the photovoltaic power station shopping malls mostly focused on new capital-loaded installations, and the purchases and purchases based on stocks were relatively inactive; after the New Deal, In the half year period (as of the end of September 2018), the quantity, amount and capacity of purchases and sales exceeded the sum of the previous three years, and the total number of purchases and sales was 11 transactions, and the trading volume was 1,295 MW (1 MW = 1000 KW). The purchase and sale amount was close to 9 billion yuan. The above-mentioned purchases and sales are mainly based on professional mergers and acquisitions. The sellers are mostly relatively weak PV companies: due to the influence of the New Deal, some of the smaller PV power plants are invested in the operators themselves, and their debts are under pressure. .

"In the future, with the overall slowdown of new PV installed capacity, large and medium-sized enterprises in the industry will rely more on mergers and acquisitions to obtain increased installed capacity, while small businesses in the professional sector will be affected by state subsidy delays and operational risks, cash. The flow pressure is relatively large, and it may be withdrawn through the method of selling property. China's photovoltaic shopping mall will gradually buy and sell from the green space shopping mall to the stock power station, and the professional concentration will be further improved.” PricewaterhouseCoopers China's power occupation and acquisition expert Lu Bing said. From the perspective of domestic shopping malls, the installed capacity of the top ten PV power plants is 30.28%.

The buying and selling characteristics of centralized and distributed PV power plants will be differentiated. PwC believes that China's power, infrastructure and mining and purchasing and sales partner Xiao Xiao believes that the traditional centralized ground power station is facing the merger and integration of the stock power station, and the distributed power station will face a more diversified funder. More challenging funding needs. "We found that in addition to traditionPhotovoltaic power stationIn addition to corporate funders, funds and financial institutions, parks/large and medium-sized manufacturing enterprises that want to gain the power of distributed photovoltaics, and even cross-professional entrants, such as some of the world's top 500 non-power companies, may have invested in photovoltaics. Shopping malls, realizing the social commitment to use green power. Compared with traditional large-scale ground power plants, distributed photovoltaics are small in scale and can be installed directly on the roof of individuals and businesses, making it easy to get close to the market.

Zou Chizhen, vice president of solar energy services at TV Rheinland Greater China, proposed that there are many risks involved in the purchase and sale of property in photovoltaic power plants. The first three categories can be summarized as skills, finance and business. The skills dangers will be reflected in power plant equipment, project management and system. In terms of functions and operation and maintenance, these risks will affect the safety of the power station system, the overall function of the quality and the amount of power generated. Therefore, the necessary skills due diligence in the PV plant purchase and sale process, identify and analyze the various potential skill hazards from each stage and level of the power plant life cycle, and assess the quality, function and safety of these skills hazards for PV power plants. The impact and impact on the sale of power plants are all critical.

In the White Paper, in addition to an in-depth analysis of how to identify and assess hazards in PV power plant skill due diligence, TV Rhein also carefully interprets critical equipment, failure statistics of test data, and some typical dangerous links at specific stages.

In the long run, PwC and TV Rhein believe that the green power based on solar energy will still be the main direction of power structure adjustment. China is gradually introducing more guidelines to support green power, including sales-side changes, green card mechanism, green power quota system, etc., all of which are expected to promote the recovery and further development of PV shopping malls. The continuous improvement of domestic new power skills and the mechanism of the transmission and distribution network will also become a long-term driving force for career development.

Disclaimer: The content is partly from the internet. In order to pass on more information, it does not mean agreeing to its views or confirming its description. Article content is for reference only. If there is any infringement, please contact in time.

The "White Paper" speculates that in the short-term, under the big picture of the tightening of the photovoltaic policy and the slowdown of macroeconomic growth, ChinaPhotovoltaic mallThree major trends will be presented: the new installed capacity will be reduced; the new installed capacity of distributed PV will exceed the centralized installed capacity and become the main force of new dedication; the PV subsidy will gradually withdraw from the shopping mall, and the parity online will be available.

In the past, the situation in which the occupational trading of photovoltaic power plants in China was relatively faint will also change. According to the White Paper, with reference to the Japanese experience, when the PV subsidy price dropped to about 40% of the peak, the mall changed from incremental to trading, and after the 531 New Deal, China's PV benchmark price was lowered by 30% from the highest peak. 40% is now near the critical value.

According to the statistics of the "White Paper", the domestic PV power plant property shopping malls showed explosive growth after the 531 New Deal: before the New Deal, the photovoltaic power station shopping malls mostly focused on new capital-loaded installations, and the purchases and purchases based on stocks were relatively inactive; after the New Deal, In the half year period (as of the end of September 2018), the quantity, amount and capacity of purchases and sales exceeded the sum of the previous three years, and the total number of purchases and sales was 11 transactions, and the trading volume was 1,295 MW (1 MW = 1000 KW). The purchase and sale amount was close to 9 billion yuan. The above-mentioned purchases and sales are mainly based on professional mergers and acquisitions. The sellers are mostly relatively weak PV companies: due to the influence of the New Deal, some of the smaller PV power plants are invested in the operators themselves, and their debts are under pressure. .

"In the future, with the overall slowdown of new PV installed capacity, large and medium-sized enterprises in the industry will rely more on mergers and acquisitions to obtain increased installed capacity, while small businesses in the professional sector will be affected by state subsidy delays and operational risks, cash. The flow pressure is relatively large, and it may be withdrawn through the method of selling property. China's photovoltaic shopping mall will gradually buy and sell from the green space shopping mall to the stock power station, and the professional concentration will be further improved.” PricewaterhouseCoopers China's power occupation and acquisition expert Lu Bing said. From the perspective of domestic shopping malls, the installed capacity of the top ten PV power plants is 30.28%.

The buying and selling characteristics of centralized and distributed PV power plants will be differentiated. PwC believes that China's power, infrastructure and mining and purchasing and sales partner Xiao Xiao believes that the traditional centralized ground power station is facing the merger and integration of the stock power station, and the distributed power station will face a more diversified funder. More challenging funding needs. "We found that in addition to traditionPhotovoltaic power stationIn addition to corporate funders, funds and financial institutions, parks/large and medium-sized manufacturing enterprises that want to gain the power of distributed photovoltaics, and even cross-professional entrants, such as some of the world's top 500 non-power companies, may have invested in photovoltaics. Shopping malls, realizing the social commitment to use green power. Compared with traditional large-scale ground power plants, distributed photovoltaics are small in scale and can be installed directly on the roof of individuals and businesses, making it easy to get close to the market.

Zou Chizhen, vice president of solar energy services at TV Rheinland Greater China, proposed that there are many risks involved in the purchase and sale of property in photovoltaic power plants. The first three categories can be summarized as skills, finance and business. The skills dangers will be reflected in power plant equipment, project management and system. In terms of functions and operation and maintenance, these risks will affect the safety of the power station system, the overall function of the quality and the amount of power generated. Therefore, the necessary skills due diligence in the PV plant purchase and sale process, identify and analyze the various potential skill hazards from each stage and level of the power plant life cycle, and assess the quality, function and safety of these skills hazards for PV power plants. The impact and impact on the sale of power plants are all critical.

In the White Paper, in addition to an in-depth analysis of how to identify and assess hazards in PV power plant skill due diligence, TV Rhein also carefully interprets critical equipment, failure statistics of test data, and some typical dangerous links at specific stages.

In the long run, PwC and TV Rhein believe that the green power based on solar energy will still be the main direction of power structure adjustment. China is gradually introducing more guidelines to support green power, including sales-side changes, green card mechanism, green power quota system, etc., all of which are expected to promote the recovery and further development of PV shopping malls. The continuous improvement of domestic new power skills and the mechanism of the transmission and distribution network will also become a long-term driving force for career development.

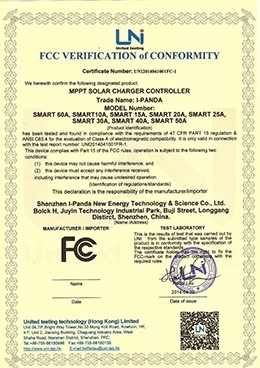

Solar Controller Solar controller 12v

Disclaimer: The content is partly from the internet. In order to pass on more information, it does not mean agreeing to its views or confirming its description. Article content is for reference only. If there is any infringement, please contact in time.