Top 10 global PV module shipments in 2018

In 2018, the global shipments of various components have been roughly determined, according to the statistics of EnergyTrend of Jibang New Energy Network, a new energy research center of Jibang Consulting.

In 2018, global component shipments reached 95GW, down 8% from 2017. The five major integrated factories (Jingke, Tianhe, Jingao, Artes, Hanwha) and two major silicon wafer manufacturers (GCL, Longjile) Leaf) constitutes the SMSL silicon-based component alliance; its status is still important. In addition, the rising star of the rising sun in the East is not to be underestimated.

Overall shipments declined slightly in 2018, but the total shipments of the top ten plants increased to 65 GW, accounting for nearly 70% of total global shipments. It can be said that the future market will show the situation of the larger Evergrande. However, in the early 2018, it was originally expected to ship 10 GW of manufacturers. At present, it seems that only Jinko Energy is expected to reach its target, which is directly related to the decline in demand after the 531 New Deal in 2018.

Product type prediction: single crystal is expected to surpass polycrystalline, double-sided products lead the cost-effective level

Overall, total shipments of monocrystalline modules accounted for approximately 48.5% in 2018; equivalent to 46GW shipments, a significant increase from 31.1% (32GW) in 2017. In 2019, the two major crystal silicon wafer factories (Longji and Central) will maintain an expanded layout. It is expected that the capacity of single crystal modules will reach 80GW, if EnergyTrend is expected to be 110GW for global demand in 2019; The ratio and shipments will definitely exceed 50%.

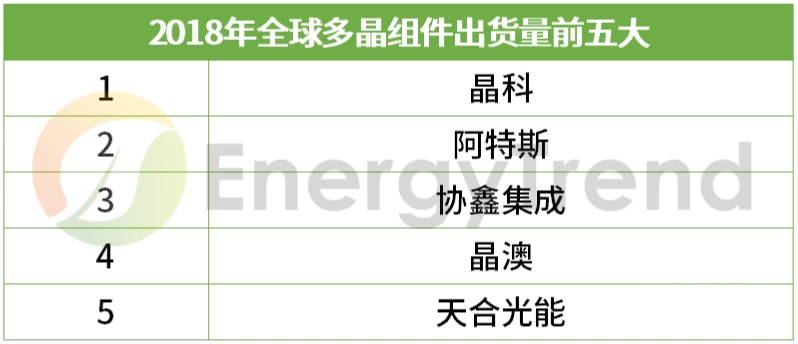

Compared with single crystal, the shipment of monolithic components in 2018 is only 50GW, which is 28.5% lower than that of 70GW in 2017. It is affected by the popularization of PERC products and the downward revision of the overall market price. Single crystal products are more favored by the market, and this situation is more obvious after the 531 New Deal. In the upstream silicon wafer manufacturers supply control and product competitiveness of the manufacturers are gradually exiting; the current supply and demand balance can maintain a stable price. The expectation of polycrystals in 2019 is also less optimistic, and it is foreseeable that the over-reversal of single crystal components is reversed.

Market expectations for 2019: Front-runner projects and overseas markets drive demand growth

Looking forward to the shipment situation in 2019, the first quarter seems to be weak in the off-season. Due to the planned deferral of installed capacity of domestic PV front-runners and the continued demand in overseas markets such as Japan, India and Australia, orders at the beginning of the year are almost all after the Chinese New Year. . If the peak season, which originally had demand in the second and fourth quarters, is expected, the overall PV market is expected to have more positive impacts than expected in 2019.

weYes Inverter manufacturer, off-grid solar controller,MPPT Solar Charge Controllersupplier, solar charge controller - Inverter factory

Disclaimer: The content is partly from the internet.In order to pass on more information, this does not mean agreeing to its views or confirming its description.Article content is for reference only.