Energy Innovation Forecast Future PV installations will continue to grow

Perhaps "steadily advancing" sounds a bit vulgar, because at least from the situation in January this year, 2019 will still be a year of broader economic and political turmoil in the international arena. Under this set of circumstances, “steadily advancing” means “resilient change”.

Putting a few cases that are not too "sunshine" - in the Standard & Poor's 500 Index, the stock market plunged nearly 20% in the three months ended December 26, 2018, and it was "continuously" on the surface. The addition of global GDP. Financial malls are known for being able to effectively guess the economic downturn. Although we can't conclude the global economy, it is at least a warning sign.

Let’s take a look at the other negative elements. From the situation in January, the House of Representatives led by the US Democratic Party has inquired about President Donald Trump that it is hard not to be uncomfortable with the danger of a political crisis in the United States; There is no agreement with the United Kingdom to trigger the European crisis, and the pressure on the international economy is becoming more and more significant.

The economic and political problems of 2019 are likely to affect the related capital flows of the “cleaner future”, but the capital contribution will not stop. In fact, we estimate that in this year, for example, how to balance wind power, photovoltaic large-scale power generation system, how to make renewable energy to complete the zero subsidy online investment, and respond to "decarbonization" and other battles, will be more than ever More time to innovate.

Next, I will analyze BNEF's 10 guesses on the 2019 international energy system, including an overview of clean energy development, wind power and photovoltaics, battery storage, electric cars, US natural gas, international LNG, oil malls, digitization, and The direction of China's energy transformation and other areas. These effects are all derived from the research results of the BNEF branches.

Decreased costs lead to capital cuts

Every year, it is necessary for the clean energy investment to speed up and maintain the level of the original investment. With the continuous decline of wind power, especially the cost of photovoltaics, the world has to expand more and more capacity to match the total investment in the previous period.

There is a kind of “mutually” connection. For example, the newly added capacity in 2017 has been added sharply, and the related capital has been added accordingly. In 2018, only the capacity has been added. I believe that in 2019, the 2018 situation will be reproduced. .

New wind power and photovoltaic equipment should be more than in the previous year in 2019 (see speculations 2 and 3), but the cost of photovoltaic installations has fallen sharply in 2018, with a drop of about 12%. The primary reason for this is that the supply exceeds demand. Caused by the status quo.

In addition, 2018 is also a brilliant year for the dominant power of the sea, with an overall contribution of US$25.7 billion. This result is due to the construction of five projects in Europe with a capital contribution of US$1 to US$3.5 billion, and China’s waters. No less than 13 arrays of funding.

Although the prospects for mid-term investment are bleak (see Speculation 3), it will still be a difficult "struggle" to surpass the previous total investment. What is more likely to be presented is that the overall contribution of clean energy will decline slightly in 2019. In addition, the weakness of the new stock market may mean that the investment in the clean energy sector of the open market will be lower than the $10.5 billion investment in 2018.

But I still believe that clean energy funding will continue to usher in a sizable number in 2019 – nearly $300 billion for the sixth consecutive year, but far from the $332.1 billion in the previous year.

Although China has adopted relevant guidelines, global PV installations will continue to be added in 2019.

According to the final data, the newly installed PV in 2018 will eventually reach 109 GW. In the coming year, there may be an addition of 125 GW to 141 GW – Europe is relocating more PV panels, and India, the Middle East, North Africa and Turkey are continuing to expand their construction plans.

China is now the largest PV market in the world, and the Chinese government is trying to harmonize the future PV support policy with the $150 billion renewable energy fund gap (about 23.4 billion US dollars) as of the end of 2017.

Along with this, the new national shopping malls have been conducting relevant auctions and bidding to purchase photovoltaic power with cost-effectiveness. Although the relevant government expects to set a new record in 2019, it is not expected.

Of course, the performance of photovoltaic power generation and performance will continue to improve, and the sharp drop in prices in the previous year will not repeat itself. Together, some companies may withdraw from the mall, but the composition will become more competitive, and the related skills innovation will be around floating photovoltaic panels, double-sided components, and large-scale energy storage and photovoltaic power generation in the public sector. Combine skills.

Land advantage power boom

Wind power shopping malls will show a new capacity boom, from 53.5 GW in 2018 to over 70 GW in 2019. Nordic, China and the United States are continuing to promote land-based power projects, many of which are now available in 2018. Financial support. The new installed capacity of offshore wind power may be added from 4.8 GW to 8.5 GW.

In the area of sea power, Europe will build 4.9 GW in 2019 and 3.5 GW in Asia, both of which are record numbers. After that, Asia will become the more pre-emptive mall in this category. According to BNEF's speculation, by 2020, Asia's production capacity will be 25% more than Europe. The sea power will gradually become the “necessary variety” in power generation skills, which will be gradually completed through “high-profile” price falls and “inspirational” planning and construction.

In wind power occupations, the price of generators has now dropped significantly. According to the 2018 BNEF Wind Price Index, fan prices have fallen by 17% since December 2016. We suspect that the megawatt cost in 2019 will temporarily stabilize below $800,000. This is about the time when the manufacturers and suppliers of land advantage machines will be "unreal".

In the past two years, professional participants have actively explored and tried to save money and improve power, and now can be said to be the highlight time of “dreams come into reality”. Together, this is likely to trigger further cost reductions and career integration, especially in China and India.

Energy storage is added to 10 GWh for the first time

In 2019, the global energy storage arrangement will exceed 10 GWh, which is the first time in the history of the mall. This includes utilities planning and “post-metering” energy storage equipment, which will be added to the estimated capacity of 8 GWh (4 GW) in the previous year.

Despite the threat of a trade war, China's battery manufacturers will still form a true global influence. Related car companies will gradually expand their collaboration with battery suppliers in China to expand their sales in China. Especially in the “busy” situation of domestic shopping malls in Korea, international energy storage developers and integrators will pay more attention to the development of China's battery industry.

The fierce competition and the recent easing of cobalt and lithium capital will push the average price down to below $150 per kWh. According to the price curve, the battery price of electric cars will even fall below this level. At the end of 2018, battery component prices have fallen to a record low of $176 per kWh.

Electric car sales growth rate of 40%

Today, there are approximately 5 million electric passenger cars traveling on the road (including public cars and other commercial vehicles). We estimate that there will be 2.6 million units sold in 2019, which represents an increase rate of about 40%, which is lower than the 70% increase rate in 2018. China will once again take the lead in the sale of 1.5 million vehicles, accounting for 57% of the global market share.

China's shopping malls are in a transitional phase, and the rate of doubling the annual sales in 2019 seems unlikely to continue. We estimate that in February, the subsidy will show a decline, but the “gradual elimination period” will continue into the second quarter.

The “new energy car quota” will show its effects this year, but the public’s demand for new energy cars is still conservative. The broader macroeconomic factors (increased interest rates and slower customer spending) will also affect global sales. In the United States and the United Kingdom and other shopping malls, direct purchase subsidies have begun to gradually decline.

BNEF estimates that sales of European electric cars will be less than 500,000 units, but the increase in sales in Northern Europe and Germany should be relatively weak. Sales in Italy have been slow, but will rebound in 2019, and the UK's sales will be flat or down after the government lifts support for the puncture-type hybrid vehicles. Sales in the North American region will generally rise from 405,000 to 425,000. The advent of Tesla Model 3 in 2018 propelled the sale of the year, but unless it can launch a lower cost model, this momentum will be difficult to maintain. The total sales in Japan and South Korea are roughly around 100,000.

New infrastructure boosts US gas exports

Assuming the climate is in a normal state, it is estimated that the average US natural gas benchmark price will remain at $2.5 to $3.5/MMBtu in 2019. As a result, the increasing demand in the southern region of the country will once again be met by sufficient output values in the north-east region. In 2018, the United States “unlocked” more natural gas production value. Although the upstream price has increased slightly, the output value in 2019 will be further added, so the price of natural gas in the lower reaches of the central and western regions will gradually decline, which will also make natural gas in this Countries that have always focused on coal-fired power generation have more competitive advantages. Natural gas will continue to soak in the Midwest in 2019.

In the south, the new capacity to transport natural gas to the Gulf Coast will not be put into production until 2020, so West Texas’ natural gas production will continue to be limited. In 2019, the weakness of natural gas prices in West Texas should be a ubiquitous phenomenon.

Together, I estimate that gas exports from the Gulf region will benefit from three newly added projects: one is the second LNG transport train at the Corpus Christi LNG transfer terminal; the other is the launch of three other new liquefaction The natural gas export facility; the third is to complete the construction of the 2.6Bcfd submarine pipeline to export natural gas to Mexico.

LNG insisted on a strong addition in the third year

Although the average price of LNG in 2018 is $10/MMBtu, which is higher than the average of $7/MMBtu in 2017, the global demand for LNG in 2018 reached 313 million metric tons, a surge of 10% from the previous year. In this regard, I estimate that the global LNG transaction will further expand by 8% to reach 340MMtpa.

As China adopts a policy to reduce the amount of coal burned to reduce pollution, the country will continue to play a "critical role" in the LNG category. Together, South Asia and Southeast Asia will have higher demand for LNG imports due to gas power development and power demand additions, infrastructure construction and a gradual decline in the value of natural gas production in Hong Kong.

Together, Japan’s restart of nuclear power is slower than expected, and Japan will receive contracted production value from its LNG supply project funded in Australia. Europe will further import, especially now, compared with Asia, Europe and the United States import and export cooperation is more rigorous. In 2018, Europe imported 6MMt of LNG, and its total import volume reached 50MMtpa, the highest level since 2011.

Compared with the price of coal, the price of LNG plays a more prominent role in supporting supply and demand. Due to the serious supply, coal futures prices remain high ($90 to $100/ton), making imported LNG an attractive option. The newly added 30MMt LNG supply capacity in 2019 will be sufficient to support the expected demand addition and stabilize its price in the spot market.

Iranian oil prices are stable

Crude oil experienced a choppy day in 2018. In the first nine months of 2018, both Brent and WTI showed an increase, but in the fourth quarter they were “overwhelmed” and dropped by 19% and 26%. The driving factors of huge fluctuations are firstly the addition of US output value, the effect of US sanctions on Iran, and the uncertainty of OPEC’s response to oil price falls. These situations have become more complex due to the addition of macroeconomic risks.

These factors that drive oil price volatility will continue to exist in 2019, but we estimate that crude oil prices will be at a positive level at the end of the year as US sanctions on Iranian oil exports expire. If the Fed adopts a relatively moderate attitude and the crisis effect caused by Sino-US trading friction is further weakened, we estimate that the price fluctuation of crude oil will be further calmed down.

Industrial category will pay more attention to the construction of the Internet of Things

Industrial equipment makers have recently invested billions of dollars in IoT, artificial intelligence, property automation and sensors. This will help sell digital software to existing customers and get a small portion of the revenue.

However, companies such as General Electric (GE), Siemens (Sie-mens), Hitachi, ABB and Schneider will have much greater ambition and layout in this area, but they will also be subject to competition with some software startups and large technology giants. a fierce competition.

Energy companies often don't have the best or most economical IoT software products, and buying software from device makers is not a customer's ambition. In 2018, both Schneider and GE applied their digital skills to independent companies – Schneider injected its software assets into Aveva, now with a 60% stake, and GE announced the establishment of an unnamed independence in December 2018. entity.

Schneider is attempting to create a more flexible software entity to find more non-Schneider customers on a larger scale. GE may also accomplish the same approach in the long run, but in the near future it has focused more on the importance of its parent company in the profession.

BNEF estimates that after acquisitions, mergers and dangerous investments, other large energy companies will also make large-scale funding on their digital platforms. Most companies will redouble their efforts in digital transformation rather than divesting the software business.

In December of last year, ABB sold its network business to Hitachi to focus more on software, automation and robotics. We estimate that companies such as Siemens and Toshiba will make joint ventures and mergers and acquisitions, and invest in the Internet of Things and achieve remarkable results.

China's long-term energy transformation will continue to advance

Although China will continue to adhere to the world's largest new renewable energy installed capacity, we estimate that the country's new PV and wind power capacity this year is 40 GW and 20 GW, which may not exceed any previous record. Instead, we should pay more attention to those wonderful but far-reaching changes that will further reshape the world's largest power system.

Now, the most important problem facing the government is how to ensure that the country's wind power and photovoltaic industry continue to support the weak domestic demand for electricity in a prosperous way under the “de-subsidy” policy. The policy is to promote renewable energy in the current benchmark price of coal-fired Internet benchmarks to complete unqualified affordable Internet access.

The most important new measure to complete this policy is “peaking”, which encourages coal-fired power plants to reduce their output to allow more renewable energy to participate in the dispatch. In other words, coal-fired power plants now need to make way for wind power and photovoltaics, and the government will implement this policy nationwide in 2019.

Other measures to ensure more renewable energy participation in dispatching are more common, including the construction of more projects close to the load center, such as rooftop PV and distributed wind power; and supply of more flexible resources such as pumped storage, coal-fired power plants Flexibility to transform and store energy, build new transmission lines, and implement renewable energy quotas.

China's development and the bottlenecks encountered by other power business places are the same - renewable energy has been carried out so far, the key battle is not how to build more renewable energy, but how to integrate the existing capacity into a cleaner, A solid and economical energy system.

So far, it is the result of BNEF's 10 major speculations on the 2019 international energy system. There is no guess here about the amount of international pollutant emissions in the coming year, because at this point, it will depend to a large extent on whether the international economy will suffer. Of course, in our efforts to control emissions and move towards a “cleaner future,” we are now seeing a clearer trend and future.

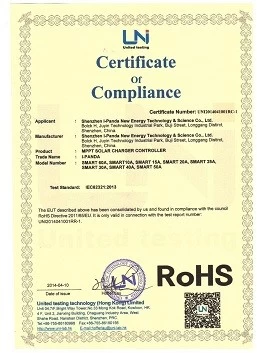

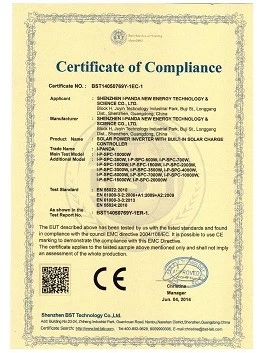

We are a collection of research and development, production, sales and service.Specializing in the production of MPPT controllerNational key high-tech enterprises for inverters, UPS, solar energy, wind energy and other energy power products. The main products include industrial grade MPPT solar controllers, solar inverters, solar power systems, UPS and other energy products. It is a leading manufacturer of MPPT controllers in China.

Disclaimer: The content is partly from the internet. In order to pass on more information, it does not mean agreeing to its views or confirming its description. Article content is for reference only. If there is any infringement, please contact in time.